All the benefits no one told you about.

Tis’ the season, right? If you are reading this, then chances are you came out of the holidays in one piece. (You might still be reestablishing your sanity, but after that much time with family, aren’t we all?) Well the attack on your emotional health is not over, not just yet. The IRS will make sure of that one. Sure you can wait until the dreaded tax day in April, or you can get it over with in January and enjoy the rest of your year.

For all of you who own a vineyard or winery or are looking to purchase a vineyard for sale, a winery for sale or land to develop any of the above on, this is for you. Believe it or not, similar to small farms, there are plenty of tax breaks to take advantage of, and perhaps this will seal the deal for all of you contemplating getting into the business.

For all of you who own a vineyard or winery or are looking to purchase a vineyard for sale, a winery for sale or land to develop any of the above on, this is for you. Believe it or not, similar to small farms, there are plenty of tax breaks to take advantage of, and perhaps this will seal the deal for all of you contemplating getting into the business.

The Wine Industry Audit Technology Guide: or ATG

Thanks to our friends at the Internal Revenue Service we now have an ATG for the Wine Industry. (You can find it at IRS.gov)Just as a heads up, this was released in March 2011, and they do not guarantee complete accuracy past that date. It is however, a good place to start to get an idea for what we’re looking at when it comes to your winery and taxes. With just over 30 pages, here is a rough overview of what you will find in this guide:

Chapter 1 – Overview of Winery/Vineyard Operations

Farming, Winery (Manufacturing), Marketing/Sales

Chapter 2 – Pre-Audit Information Gathering

Information Sources

Chapter 3 – Audit Considerations

Initial Information Document Request, Balance Sheet Accounts, Income & Expense Accounts

Chapter 4 Capitalization & Tax Accounting

Vineyard Operations, Vineyard Development Costs, Grape Growing Costs and Recognition of Income, Depreciation Methods, Winery Operations

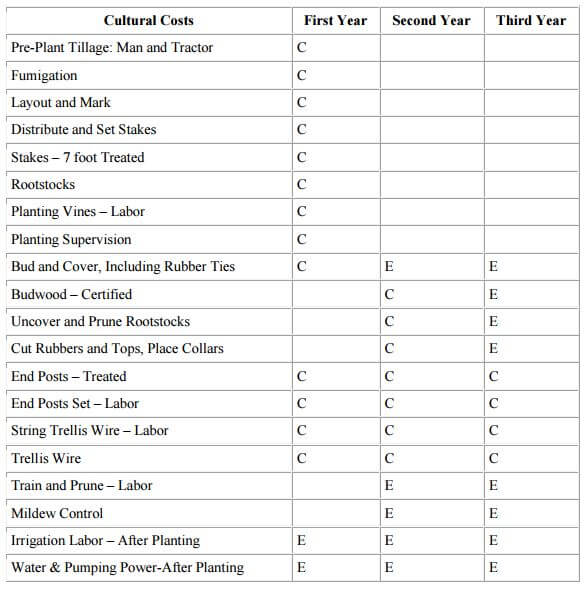

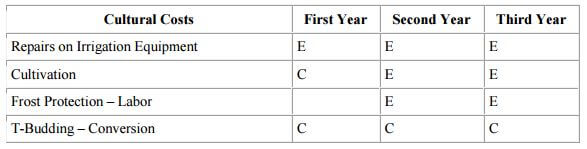

In Chapter 1 the guide outlines the timing and treatment of development costs. They are as follows:

“Guidelines for capitalizing and expensing vineyard establishment costs when UNICAP does not apply. If UNICAP applies, all costs are capitalized until the vineyard starts producing a crop. The following is an example of costs noting C for Capitalize and E for Expense. “

You can visit the IRS website to read on if you like. It is also important to note, many CPA firms specialize in the wine industry.

Digging around the internet it’s not hard to come across sites with all sorts of credits. Deciphering them, and deciding if they apply to your business is an entirely different ballgame. In the next bit, I am going to cite the websites and the information I found, hopefully getting it all in one place for a quick read.

Virginia Decoded: Farm Wineries and vineyards tax credit.

Qualified capital expenditures –

Qualified capital expenditures –

This refers to all expenditures made by the taxpayer for the purchase and installation of: barrels, bins, bottling equipment, capsuling equipment, chemicals, corkers, crushers, recognized fermentation devices, fertilizer and soil amendments, filters, grape harvesters, grape plants, hoses, irrigation equipment , labeling equipment, poles, posts, presses, pumps refractometers, refrigeration equipment, seeders, tanks, tractors, vats, weeding and spraying equipment, wine tanks and wire.

Virginia Vineyard –

Agricultural land located in the state of Virginia that has at least one acre of land dedicated to grape growing that are either used or intended to be used for winemaking by a Virginia farm winery.

Tax Credit –

For any year after 2011 any Virginia farm winery is entitled to a tax credit for qualified capital expenditures in connection with the establishment of new Virginia farm wineries or vineyards as well as capital improvements. The credit is equal to 25% of all qualified capital expenditures.

If the tax credit exceeds the taxpayer’s liability for the taxable year, the excess may be carried over and used against any subsequent liabilities in the next 10 years.

In the event of a partnership, S-corporation, or LLC, the credit will be allocated based in proportion to ownership.

Fox Business: Tax Tips for Farmers (Sole Proprietors only)

If the vineyard and or winery is owned by a sole proprietor than farming considered a small business.

The Basic Rules:

- Net profit is subject to self-employment tax

- All “ordinary and necessary” business expenses may be deducted

- All workers you hire are subject to payroll tax withholding unless they qualify as independent contractors

- Net Operating losses can be carried backwards or forwards

- Self-employed health insurance can be deducted

- You may deduct retirement plan contributions to an IRA etc.

- Cost of goods sold: If you purchase something for resale, you may take the deduction why it sells, not when you purchase it

Additional tax breaks offered to farmers (and not to small businesses)

- If as a farmer you experience an exceptionally high income one year, you can elect to average your income by considering the past 3 years of lower income in order to reduce the current tax bull. (This used to apply to everyone, but was written out of the tax code in 1986, except for the lucky farmers.)

- Rental income is not generally subject to self-employment tax, however if you materially participate in farming activities (such as share-cropper arrangement or being paid in crops) then that becomes subject to self-employment tax.

- If you are a vineyard owner you may allocate a certain percentage of your land as “appellation” and deduct amortization based on that value.

- Fuel used for off road activities and farming can be subject to federal excise tax refunds or credits.

- “Ordinary and necessary” expenses can include: clearing brush from an area you wish to farm, cleaning out draining ditches, and soil and water conservation (As long as it does not exceed 25% of your income!)

- Some income can be declared in a subsequent years.

- Note: Some income is not taxable, such as income from cost-sharing conservation programs.

Wines & Vines: Hidden Deductions for Wineries and Growers

This article takes note that many agricultural businesses have the possibility of many tax breaks that other businesses do not. Here are a few to note:

This article takes note that many agricultural businesses have the possibility of many tax breaks that other businesses do not. Here are a few to note:

Agricultural Specific Provisions

As stated in the previous section, soil and water conservation expenses as well as expenses incurred to protect endangered species, can be deducted.

Agricultural Businesses can claim a net operating loss up to 5 years, as opposed to 2 with other businesses.

Many growers have the option to deduct post-harvest/pre-bud break costs as long as they did not use the cash method.

Inventory Confusion

Wines that are aged: the cost of production applies to more than just the current year, but all aging years.

Grape costs can be handled differently for tax purposes.

When taking inventory, it is important not to lump all of the wines together by varietal. Be sure to note the variety, appellation, self-grown or bought, different vintages within the same production, blends, reserves and packaging.

State Taxes

States are getting a bit feisty and are trying to raise money through audits. If you are nervous about this, file a voluntary disclosure agreement with the tax agency in regards to unusual claims.

Agriculture equipment can also be filed as a sales tax exemption, as well as solar panels that help power a farm, and the trellis that hold your vines.

Some other odd exemptions are seeds, plants and fertilizers, as well as promotional and advertising materials, and oak barrels.

Domestic Producers

This can allow up to a 9% tax deduction! The rules are that the storage, handling and processing as well as growing or winemaking must happen in the states.

All in all, after you have taken a read or skim through this article, one of the biggest differences to note is the difference in taxation for a sole proprietor verses partnerships, corporations, etc. It is also very important to take note that your vineyard is defined as a small farm. The USA loves their small farms – well, maybe they love all their farms. After much lobbying done on behalf of large farms though, small farms can reap many agricultural tax benefits that can help them keep money invested in the vineyard and winery, which is pretty great.

No, I did not make filing taxes any less painful. I am fairly positive that that would have been nearly impossible given my inability to void the entire process. There are tons of resources out there to help you along in this process and I highly advise you to talk to a professional who specializes in vineyards and wineries, perhaps even before you own one so that you may have a better idea, certainly a more knowledgeable approach to the business side of owning and operating a vineyard. Once that’s out of the way, we can all get back to what we really enjoy: winemaking.

Best of luck with the IRS, it will all be over soon!